What kind of insurance do I need to drive in Idaho?

Nowadays, it’s a very common question: What kind of insurance do I need to drive in Idaho? Today, we will discuss car insurance coverage in Idaho. Types of Idaho’s auto insurance coverage, Idaho’s car insurance cost, the auto insurance claim process, and ways to reduce auto insurance costs in Idaho. In Idaho, third-party liability coverage is the most basic kind of auto insurance, and it is required. It shields you from having to pay for any damages to someone else’s property as the policyholder. If you cause an accident that results in someone being hurt or killed, you will also be covered.

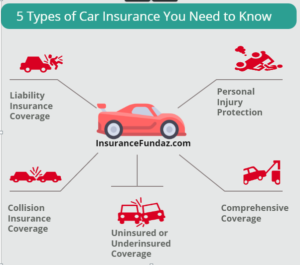

Types of Idaho’s auto insurance coverage

Liability Coverage

Bodily Injury Liability

Physical harm When a policyholder is at fault in a collision, liability coverage assists in covering the costs of injuries to other drivers and passengers. Usually, this coverage pays for the other person’s medical expenses.

According to Idaho law, your auto insurance policy must have a minimum of $25,000 per person and $50,000 per accident in bodily injury coverage. The maximum amount of money the insurance company is required to pay to the other party on your behalf is specified in the coverage limits section of your policy. More protection, however, can be obtained by purchasing greater limits.

Property Damage Liability

Property Losses When you cause harm to another person’s property (such as a car, fence, telephone pole, etc.), liability pays for such harm. According to Idaho law, your vehicle insurance policy must provide a minimum of $15,000 in property damage liability coverage. The maximum amount of money your insurance company is required to pay to the other party on your behalf is specified in the coverage limits section of your policy. More protection, however, can be obtained by purchasing greater limits.

Uninsured and Underinsured Motorists

Unless a named insured has expressly refused the coverage in writing, insurance firms are obligated to offer uninsured motorist (UM) and underinsured motorist (UIM) bodily injury coverage. The coverage limits you select for your bodily injury liability coverage limits will often match the coverage limits for UM/UIM bodily injury coverage; however, this may vary between insurance companies.

The Idaho Uninsured Motorist and Underinsured Motorist Disclosure Form, which explains the UM/UIM Bodily Injury coverages, gives the named insured the option to reject either or both coverages, and clarifies the differences between the two (2) types of Underinsured Motorist Bodily Injury coverage, is a mandatory disclosure that insurance companies must give to the named insured.

Types of Underinsured Motorist (UIM) Coverage:

Excess Your UIM coverage limits provide coverage for medical injuries you and/or your passengers experience over and beyond what is covered by another party’s insurance if your insurance carrier offers “excess” UIM coverage limits.

For instance, if the at-fault party has $25,000 in bodily injury liability coverage and you have $25,000 in UIM coverage, your UIM policy raises the available bodily injury coverage to $50,000 above the at-fault motorist’s coverage limit.

On the other hand, if the at-fault party has $25,000 in bodily injury liability coverage and you have $100,000 in UIM coverage, your UIM policy raises the available bodily injury coverage to $125,000 over the at-fault motorist’s coverage.

Difference in Limits or Offset

If your insurance provider provides “difference in limits” or “offset” UIM coverage limits, any funds recovered from the insurance of a third party will be applied to reduce or eliminate the coverage for medical injuries you and/or your passengers may experience.

Example: If you have $25,000 in UIM coverage and the at-fault party has $25,000 in bodily injury liability coverage, your UIM coverage does not provide additional coverage above the at-fault motorist’s coverage because they have the same limit.

Conversely, if you have $100,000 in UIM coverage and the at-fault party has $25,000 in bodily injury liability coverage, your UIM coverage covers any deficiency in the at-fault motorist’s bodily injury coverage, as if the at-fault motorist had bodily injury coverage at your UIM limit.

In other words, if the cost of your medical injuries exceeded the at-fault motorist’s $25,000 limit, you would have up to your $100,000 limit (an additional $75,000) available to cover the cost of your medical bills related to the accident.

Idaho car insurance state minimums

| Coverage type | State requirements bodily |

| injury liability assists in paying for costs associated with the harm or death of a pedestrian or another driver in cases where you are at fault for the accident. |

$25,000 limit per person/$50,000 limit per accident property |

| damage liability

helps pay for costs associated with damaging someone else’s property, such as cars, houses, buildings, and other structures, in cases where you are at fault for the accident. |

$15,000 limit uninsured |

| d motorist assists in paying for your medical costs in the event that you are in an accident and the at-fault driver is uninsured. |

Not required |

| Underinsured motorist assists in paying for your medical costs in the event that you are in an accident and the at-fault driver does not have enough liability insurance. |

Not required: personal |

| l injury protection This aids in paying for funeral or hospital costs in the event that you or any of your passengers are injured in an accident. |

Not required collision |

| n helps pay for the costs of replacing or repairing a car that has been involved in an accident. |

Not required¹ |

| Comprehensive helps pay for the costs of replacing or repairing a car that has been stolen or harmed by vandalism or storm Idaho car insurance discounts are not |

t required¹

|

Contrary to popular belief, it is feasible to receive high-quality insurance at a lower cost. You could be able to receive savings when you obtain an Idaho vehicle insurance estimate from Allstate. Among the discounts that are offered are:

- Discounts for several policies and bundling

- discount on new cars

- Early Signing Discount®: A discount for conscientious payers

- Discount for smart students

- Examine the various customized auto insurance discounts available to you and save money without sacrificing coverage

Insurance bundling discounts

When you want various forms of protection, Allstate offers discounts for bundling policies. For example, combining your homeowners’ and auto insurance together might save you up to 14%*. When you combine several Allstate insurance plans, you may easily access them, examine your coverage, and make payments with just one sign-in.

Factors that can impact your car insurance rates in Idaho

- Apart from choosing the appropriate coverages, limits, and deductibles, the following variables may also have an impact on your Idaho auto insurance quotes:

- What kind of vehicle (year, make, model) you are insuring?

- Your yearly mileage and driving habits

- demographic elements such as zip code

- Any savings you might be eligible for

- Find out more about these variables that may affect the cost of your auto insurance.

Idaho’s rules on electronic proof of insurance

You might be wondering if you need to find a paper copy of your insurance card or if you can use an electronic one if you are pulled over by the police and requested to provide proof of insurance. You may use your mobile device to display an electronic copy of your insurance card in Idaho.

To access a digital ID card, utilize the Allstate mobile app on your iPhone® or Android® device.

Idaho’s penalties for driving without proof of insurance

Idaho keeps a close eye on each registered car’s insurance coverage. Owners who have not had insurance for two months in a row will be issued a notice and given 30 days to either acquire an exemption or produce proof of insurance before having their registration suspended [2].

Owners will need to pay a $75 fee and produce evidence of insurance in order to have a suspended registration renewed. In addition, you might need to keep your SR-22 insurance current. Any additional infraction (within five years) may result in a $1,000 fine and/or a six-month jail sentence [3].

Car insurance costs in Idaho

How Much Does the Minimum Car Insurance Cost in Idaho?

When determining rates, auto insurance companies take a number of things into account. These contain private details about you, such as your age, driving record, and experience. Along with where you reside in Idaho, another factor is how well you manage your credit score.

An Idaho driver’s typical annual cost for auto insurance is roughly $745, but you can get more economical rates by comparing quotes from many insurers. The lowest minimal auto insurance in Idaho is provided by USAA, which charges an average of $182 annually to current and past service members and their families. Another reasonably priced choice is State Farm, which provides insurance at more accessible prices. Similar coverage policies run about $284 a year on average.

These costs should not be used to compare insurance quotes because they are merely estimates based on rates for a typical driver in Idaho.

The rates displayed above are for policies that meet Idaho’s minimum liability coverage requirements for auto insurance, which are 25/50/15. Money Geek employed a 40-year-old man with good credit who was driving a 2010 Toyota Camry and had a spotless record.

What Is the Minimum Car Insurance Requirement in Idaho While Leasing a Car?

Because the lender sets the criteria, Idaho’s standards for auto insurance for leased vehicles may differ from those set forth by the state. The majority of leasing businesses would rather you have a full-coverage auto insurance policy since it offers them additional security for their investments. In addition to needing collision and comprehensive insurance, they might also need 100/300/50 minimum liability coverage.

To find out what your lender requires, you should get in touch with them directly. Additionally, as their terms of payment and other policies are important to your agreement with them, you might inquire about them.

Take into account the following factors when determining the amount of auto insurance you require:. In Idaho, it is advisable to obtain a full-coverage insurance policy with a minimum of 50/100/50 liability coverage, as this provides superior protection in the event of an accident. It might be a good idea to incorporate uninsured motorist coverage into your policy. Among the states with the highest percentage of uninsured drivers, Idaho is presently ranked 20th. Despite the fact that it is against the law to drive without insurance in Idaho, 13.2% of motorists do not have coverage.

Average car insurance rates in Idaho by driver age

It’s a well-known fact that the cost of auto insurance changes with age. Young drivers typically pay more for auto insurance because insurers consider them to be riskier to insure.

In Idaho, a 16-year-old driver’s auto insurance costs $5,816 a year, while a driver in their 50s pays $875.

IDAHO AUTO INSURANCE PRICES BY AGE

Age Average Yearly Rate

16 $5,815.51

17 $5,130.31

18 $4,564.98

19 $2,470.29

20s $1,422.82

30s $1,008.56

40s $948.12

50s $874.82

60s $906.53

70s $1,102.76

IDAHO CAR INSURANCE PREMIUMS FOR WOMEN AND MEN

Gender Average Annual Cost

Male $1,023.51

Female $992.39

IDAHO CAR INSURANCE COSTS BY MARITAL STATUS

Marital Status Average Annual Rate

Single $1,023.51

Married $964.91

Divorced $1,018.47

Widowed $1,018.47

IDAHO CAR INSURANCE PREMIUMS AFTER TICKETS

Violation: Average Annual Premium

DWI/DUI $1,566.07

Reckless Driving $1,593.65

At-Fault Accident (<$1,000) $1,483.56

At-Fault Accident ($1,000-$2,000) $1,582.21

At-Fault Accident (>$2,000) $1,483.56

Open Container: $1,584.53

Speeding (21-25 MPH > limit) $1,265.34

Speeding (16-20 MPH > limit) $1,197.66

IDAHO AUTO INSURANCE COSTS BY COVERAGE TIER

Coverage Level: Average Annual Rate

| $100K/$300K/$100K Bodily Injury/Property Damage — Liability Only | $427 |

| $100K/$300K/$100K Bodily Injury/Property Damage: $1,000 Comprehensive/Collision | $888 |

| $100K/$300K/$100K Bodily Injury/Property Damage: $500 Comprehensive/Collision | $984 |

| $50K/$100K/$50K Bodily Injury/Property Damage — Liability Only | $371 |

| $50K/$100K/$50K Bodily Injury/Property Damage: $1,000 Comprehensive/Collision | $839 |

| $50K/$100K/$50K Bodily Injury/Property Damage: $500 Comprehensive/Collision | $937 |

| State Minimum — Liability Only | $325 |

| State Minimum: $1,000 Comprehensive/Collision | $794 |

| State Minimum: $500 Comprehensive/Collision | $892 |

Coverage Level: Average Annual Rate

Numerous factors, such as your state, location, and even ZIP code, affect your auto insurance price. The total cost of a city or ZIP code can be impacted by the frequency of accidents as well as the likelihood of auto theft or vandalism.

The most populous cities in Idaho are shown in the table below:

| City

Boise City |

Average annual cost

$991 |

| Meridian | $983 |

| Nampa | $1,065 |

| Idaho Falls | $1,116 |

| Caldwell | $1,076 |

| Pocatello | $1,141 |

| Coeur d’Alene | $1,082 |

| Twin Falls | $1,048 |

| Post Falls | $1,067 |

| Lewiston | $1,086 |

No-Fault Insurance in Idaho Information Idaho is at fault. This implies that you will need to have adequate insurance to pay for any injuries and property damage to both sets of drivers, passengers, and vehicles if you are involved in an accident and are found to be the cause of it.

ways to reduce auto insurance costs in Idaho

You might be able to reduce your premium if you’re receiving high quote prices for auto insurance in Arkansas. Finding the areas where you can make the most improvements will depend on how well you assess your personal rating variables, but the following are some essential cost-saving techniques:

Shop around: Rates for auto insurance vary from one provider to the next, so switching may be the easiest way to save money on your premium. Obtain quotations from multiple local providers to determine which one is best for you.

Compare discounts: Discounts vary in how much you can save depending on the business. Even though two businesses might provide identical savings options, you might save more money with one of them. Rather than searching for potential discounts online, you might choose to chat with an agent to find out how much you can save with a carrier.

Increase your deductible: If you raise your deductible, your premium will be less, but you will have to pay more out of pocket if you ever need to submit a claim.

Increase your credit score: In Arkansas, it is permissible for auto insurance firms to compute an insurance score that influences your rate using your credit information. Research has indicated that drivers with lower credit ratings compared to those with higher scores have a statistically higher likelihood of filing a claim. Your premium may therefore decrease if your credit score rises.

Conclusion

Idaho’s auto insurance laws appear to be rather basic, following the general guidelines that apply to many states in the United States. It typically includes medical payments coverage, comprehensive/collision coverage, uninsured/underinsured motorist protection, and liability coverage, which helps pay expenses if you are at fault in an accident. To make sure your policy fits your needs and adheres to Idaho’s insurance laws, it’s critical to go over and comprehend all of its specifics.

I believe if you can observe my entire blog, you may get a valid idea of car insurance coverage in Idaho . Types of Idaho’s auto insurance coverage, Idaho’s car insurance cost, the auto insurance claim process, and ways to reduce auto insurance costs in Idaho.